Welcome back my fellow IIN-siders, I hope August was a good month for you and I hope that your portfolio performed well. Last month I did a deep dive into 3 recommends stock picks.

If you missed it, you can check it out here.

How Did These Stocks Do?

From the beginning to the end of August, these stocks performed as follows:

CALM was up 3.29%

JEPQ was up 0.02%

ABR was down 5.84%

ABR was only down $0.99 but with the low stock price, this equates to a whopping -5.84%.

This month we’re getting closer to our departure date for our travels. The missus and I are planning to head south from Pennsylvania to Florida to swim with manatees this winter.

It’s something she’s wanted to do for years, and who am I to say no. Plus it will get me out of the cold northeastern winters and into a climate where I won’t freeze.

The days may be hot and humid currently, but soon they’ll be cool and pleasant. This got me thinking about the market and our income portfolio in particular.

The Market Is Always Changing

Sometimes the market is hot and sometimes the market is cool, but the overall objective is to maintain a consistent payout of income, no matter how the market is behaving.

Inflation, recession, digital dollar, bull market, bear market; all these descriptors have been used to discuss the market lately, and for most of 2023. The question is, does it really matter what people are saying?

I feel that the doomsayers have completely misjudged the markets in 2023. At the same time the bulls have misjudged the markets as well. In reality, it’s been a little of both.

Some sectors, like technology, have exploded. All the while some sectors, like telecom and office REITs, have had very rough years. Isn’t this how the markets always are though? Some areas are wicked good and others are lagging.

Sometimes It’s All Doom And Gloom

August was pretty much a shit show. I mean any news in August was met with a sell off of some sort. The major indexes are all down 6-9% and it seems that no matter what happens, it leads to more red in your portfolio.

Our IIN portfolio has not been immune. We got hit and hit hard. The value of our investments is down 12% so far in August. But we aren’t panicking because we’re focused on income.

As long as you’re in quality investments, when your stocks go down, you’re stocking up on more shares at lower prices. And this leads to more income in the long run.

We recently did a podcast episode about how down markets can be a blessing in disguise.

I guess for me the objective is to be like I will be this winter, just coasting along with minimal effort swimming beside some manatees. But for now, I’ll be providing a deeper dive into 3 more investment ideas.

Business Development Companies

First we need to cover what a Business Development Company (BDC) is. A BDC invests in privately owned companies that are typically small or medium in size.

These companies need the support of a BDC, generally because they’re experiencing difficulty, going through a period of growth, or aren’t able to secure financing in more traditional ways, like through banks or bond issuance.

Apparently, banks can’t or won’t lend to small or medium sized companies. BDCs were actually created in the 1980s in order to boost America’s struggling economy and create new jobs by supporting small businesses that were having a hard time raising money.

As long as a BDC meets certain income, diversity, and distribution requirements, the company pays little or no corporate income tax. This favorable tax status doesn’t come for free, but it is a huge win for us as investors.

The deal is that BDCs must pay out at least 90% of their taxable income in the form of ordinary dividends to their investors each year. Yes, you read that right, 90%!

If real estate investment trusts (REITs) are coming to mind, you know your stuff. This tax status and dividend deal is very similar to the set up for REITs.

To comply with federal regulatory requirements, a BDC’s portfolio must be adequately diversified. No one investment can account for more than a quarter of the BDC’s holdings and at least 70% of the BDC’s investments must be with U.S. public or private companies with market capitalization under $250 million.

If you want to know more we did an entire podcast episode on BDCs.

Investment Ideas To Add To Your Portfolio

So back to those 3 investments. One is my favorite technology based BDC that I’ve been in and out of multiple times through the years.

The second will be another BDC. It’s one that we’re currently in in our IIN portfolio. And the last one is a covered call approach to the S&P 500.

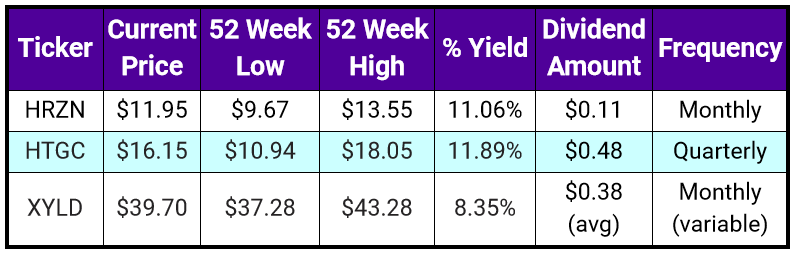

The 3 stocks are HRZN, HTGC and XYLD. If you don’t have these in your income portfolio, you may want to do some follow-up research and decide if they are a good fit for you.

HRZN – Horizon Technology Finance Corporation

Horizon Technology Finance Corporation is a BDC specializing in lending and investing in development-stage investments.

It focuses on making secured debt and venture lending investments to venture capital-backed companies in the technology, life science, healthcare information and services, cleantech and sustainability industries. It seeks to invest in companies in the United States.

Trading at slightly over 24x its P/E ratio which is typically high AF, but this is actually low compared to others in this sector. HRZN is one of the better BDCs on the market.

From December 2021 to July 2023 revenue has doubled to $102.5 million while EPS has been flat in the same time period. So they’re making more money but share dilution has led to no real growth on an earnings per share basis.

For whatever they’re worth, projections estimate that revenue will grow 10% and EPS will double in the next 12 months. The red flag for HRZN is that since 2021, debt surpassed income. But I suspect that within 12 to 18 months, debt will again be covered by equity as it was from 2012-2020.

HRZN pays a monthly dividend of $0.11, which it raised by 10% in December of 2022. This $0.11 yields 11.06% currently. In the area of high yield investments, HRZN seems to be one of the safer 10%+ yields out there.

To me personally, HRZN is actually a good growth stock that pays a high dividend. I expect maybe a dividend cut within the next 12 months, but within 5 years based on the data, I expect the dividend to be raised to probably the $0.15 a month range.

HRZN is slightly overvalued as of this writing, but because of its promising growth data. Locking in a 10% yield for a slight premium (like 5% overpriced) is acceptable. However, the savvy investor will wait until HRZN falls into the $10.75-$11.00 range.

HRZN is a hold for now. It becomes a buy when it falls under $11.00.

HTGC – Hercules Capital, Inc.

One of my absolute favorite investments in the IIN portfolio is HTGC. I love what this company does and stands for.

Hercules Capital, Inc. is another BDC. The firm specializes in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups, to expansion stage including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalizations and refinancing and established-stage companies.

They provide growth capital financing solutions for capital extension; management buy-out and corporate spin-out financing solutions; company, asset specific, or intellectual property acquisition financing; convertible, subordinated and/or mezzanine loans; domestic and international corporate expansion; vendor financing; revenue acceleration by sales and marketing development, and manufacturing expansion.

HTGC provides asset-based financing with a focus on cash flow; accounts receivable facilities; equipment loans or leases; equipment acquisition; facilities build-out and/or expansion; working capital revolving lines of credit; inventory.

The firm also provides bridge financing to IPO or mergers and acquisitions or technology acquisition; dividend recapitalizations and other sources of investor liquidity; cash flow financing to protect against share price volatility; competitor acquisition; pre-IPO financing for extra cash on the balance sheet; public company financing to continue asset growth and production capacity; short-term bridge financing; and strategic and intellectual property acquisition financings.

It also focuses on customized financing solutions, emerging growth, mid venture, and late venture financing. The firm invests primarily in structured debt with warrants and, to a lesser extent, in senior debt and equity investments.

HTGC generally seeks to invest in companies that’ve been operating for at least 6 to 12 months prior to the date of their investment. It prefers to invest in technology, energy technology, sustainable and renewable technology, and life sciences.

Within technology the firm focuses on advanced specialty materials and chemicals; communication and networking, consumer and business products; consumer products and services, digital media and consumer internet; electronics and computer hardware; enterprise software and services; gaming; healthcare services; information services; business services; media, content and information; mobile; resource management; security software; semiconductors; semiconductors and hardware; and software sector.

Within energy technology, it invests in agriculture; clean technology; energy and renewable technology; fuels and power technology; geothermal; smart grid and energy efficiency and monitoring technologies; solar; and wind.

Within life sciences, the firm invests in biopharmaceuticals; biotechnology tools; diagnostics; drug discovery, development and delivery; medical devices and equipment; surgical devices; therapeutics; pharma services; and specialty pharmaceuticals. It also invests in educational services.

They invest primarily in United States based companies and considers investment in the West Coast, Mid-Atlantic regions, Southeast and Midwest; particularly in the areas of software, biotech and information services.

This company prefers to invest between $10 million and $250 million in equity per transaction. It invests generally between $1 million and $40 million in companies focused primarily on business services, communications, electronics, hardware, and healthcare services.

The firm invests primarily in private companies but also has investments in public companies. For equity investments, the firm seeks to represent a controlling interest in its portfolio companies which may exceed 25% of the voting securities of such companies.

HGTC seeks to invest a limited portion of their assets in equipment-based loans to early-stage prospective portfolio companies. These loans are generally for amounts up to $3 million but may be up to $15 million for certain energy technology venture investments.

The firm allows certain debt investments to have the right to convert a portion of the debt investment into equity. It also co-invests with other private equity firms.

They seek to exit their investments through initial public offering, a private sale of equity interest to a third party, a merger or an acquisition of the company or a purchase of the equity position by the company or one of its stockholders.

The firm has structured debt with warrants which typically have maturities of between two and seven years with an average of three years; senior debt with an investment horizon of less than three years; equipment loans with an investment horizon ranging from three to four years; and equity related securities with an investment horizon ranging from three to seven years.

Their preference is to invest through its balance sheet capital.

All I have ever done when holding this company is make money. They raise the dividend all the time, which is super nice, but along with dividend increases price appreciation also occurs.

The very best income investing stocks are the ones that grow along with their dividend.

Granted that HTGC is only up about 23% this year (ha ha) and only up 50% the past 3 years, these gains do not include dividend reinvestments. If you include dividends, HTGC is up 33.2% YTD and for 3 years it is up 98%.

Like I said, this one is a grower. The current dividend is $0.40 but 10 of the last 11 quarters, HTGC paid a special dividend of $0.08. Yes you read that right, 10 of the last 11 dividends, HTGC has paid a special dividend on top of the regular dividend.

What makes this investment even sweeter is that HTGC trades at only 7.4x P/E, whereas the industry average is between 27x to 30x.

Still not sold on HTGC?

It has over 20% return on equity, a profit margin of 75%, and has only a 68% dividend payout rate. Also it’s forecasted to grow by damn near 10% per year for the next 5 years and trades at a discount of almost 50%.

The numbers indicate that HTGC should be trading above $30 per share, but right now it’s only around the $16 range!

HTGC is a BUY, BUY, BUY up to $20.00.

XYLD – Global X S&P 500 Covered Call ETF

One of the experts’ favorite investments is a broad S&P index of some sort like VFIAX or SWPPX. I agree with the concept, but not their choice of stock. I want something that pays me a dividend every month.

As an income investor we want monthly or quarterly income not just capital appreciation. The broad index funds may perform slightly better over 3 years by 1% or 2%, but you literally get no income from them. I’ll take a 12% yield with slightly less capital appreciation any day.

That’s where XYLD comes in. XYLD is a covered call S&P 500 ETF. Meaning XYLD writes options on the stock they hold in their portfolio and sells those options for cash which is passed on to the shareholders.

From their website:

The investment seeks investment results that, before fees and expenses, generally correspond to the performance of the CBOE S&P 500 BuyWrite Index. The fund invests at least 80% of its total assets in the securities of the underlying index. The underlying index measures the performance of a hypothetical portfolio that employs a covered call strategy. A covered call strategy is generally considered to be an investment strategy in which an investor buys a security, and sells (or “writes”) a call option on that security in an attempt to generate more income.

Global X S&P 500 Covered Call ETF

I suppose this is a fancy way of saying what I just said in the paragraph before hahahaha.

There aren’t a lot of fundamentals to discuss, but one area that is tough is the varying yield and distribution rates. If you need a set income stream per month, a varying rate can make things difficult as it’s always changing.

Some months XYLD yields 12% and pays $0.55, and other months it yields 7% and pays $0.35. The distributions are determined by taking the amount they make from the covered calls issued, minus fees and operating expenses. It’s quite simple and why the rate is always varying.

The one HUGE drawback for this type of investment is that you’ll always have a capped upside. This means that when an S&P index fund go in lock-step with the S&P, XYLD will always lag behind.

If the S&P goes up 10%, XYLD will never go up that 10%. But the flip side works in XYLD’s favor. When the S&P tanks, XYLD will go down yes, but nowhere near as far as the S&P does. It has a 0.57 beta.

So if you think the S&P will enter bull market territory, turn your DRIP off and collect cash to put into something else. If you however think the S&P will enter bear territory, turn the DRIP back on and collect as many shares as you can.

To me, XYLD and its brethren QYLD and RYLD are good broad market ETF’s that cover the NASDAQ, the S&P 500 and the Russell2000. Every portfolio should have 5-10% of the total portfolio invested in something like these.

XYLD is a BUY up to $41.50 at least.

Wrap Up And Upcoming Topics

There you have another month of ideas to invest in. I truly hope you’re beginning to see how high yield investing can be very lucrative.

So far we’ve discussed CALM, JEPQ (which I vastly prefer over QYLD), and ABR. This month we’ve discussed HRZN, HTGC (which to me is like a must have for any starter portfolio) and XYLD.

If you have the money, I would invest soon since August has been an absolute dumpster fire and everything is pretty much on sale.

Next month I think we’ll talk about SLVO, USOI and GLDI. These are very lucrative investments that focus on gold, silver and oil without physical ownership.

So either keep your peepers open for the October issue, or get on our email list where you’ll be notified the minute our monthly newsletters get posted.

I’d just like to take a moment and say thanks to everyone who has listened to the podcast, checked out the website, and followed us on our socials.

We have a dream of helping others reach financial freedom wayyyyyyy quicker than what the “experts” suggest. That’s where this was all born from. Once we cracked the code, we wanted to get the word out.

We want more people to become empowered and take control of their own future. Because the more people there are that are happy and financially stress free, the more people will be moved to make a difference in the world.

Until next month my awesome Minions,